Job Market Cooled but Was Still Strong in August

Job growth slowed in August but stayed solid, suggesting that rising interest rates and fear of a possible recession are leading companies to pull back on hiring — but that the labor market recovery remains resilient.

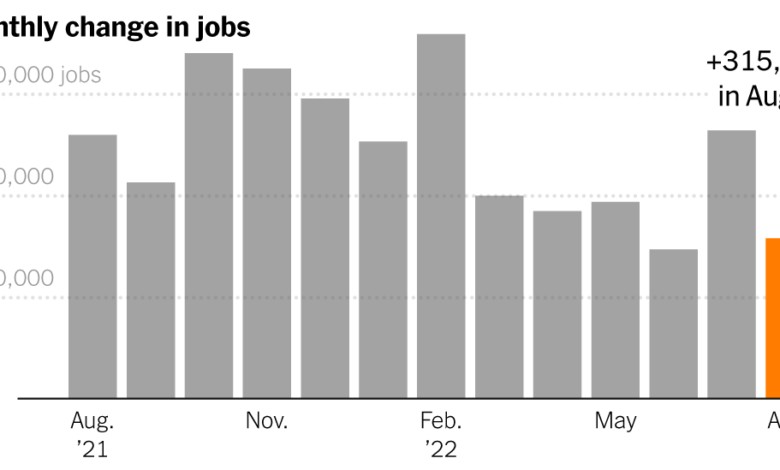

Employers added 315,000 jobs last month on a seasonally adjusted basis, the Labor Department said Friday. That was down from 526,000 in July, though it still represented a strong pace of growth.

The unemployment rate rose to 3.7 percent, from a half-century low of 3.5 percent in July. That rate only counts people who are actively looking for jobs, and the uptick came alongside a big increase in the size of the labor force — a sign that rising wages, abundant job opportunities and the receding pandemic are leading more people to look for jobs.

Economists have been saying for months that job growth was likely to slow as the economy comes down from last year’s vaccine-fueled boom and as higher borrowing costs make it harder for businesses to expand. Instead, the labor market remained red hot even as other parts of the economy, such as the housing market, turned sharply lower. The data released Friday indicated the long-delayed slowdown may finally have begun.

“It’s definitely a downshift from what we saw earlier in the year,” said Sarah House, an economist at Wells Fargo. “But step back and look at the bigger picture here. The fact that we’re still putting up gains of over 300,000 even as we’ve recovered all the jobs lost, that’s still a really impressive feat.”

The State of Jobs in the United States

Economists have been surprised by recent strength in the labor market, as the Federal Reserve tries to engineer a slowdown and tame inflation.

- August Jobs Report: Job growth slowed in August but stayed solid, suggesting that the labor market recovery remains resilient, even as companies pull back on hiring.

- Black Employment: Black workers saw wages and employment rates go up in the wake of the pandemic. But as the Federal Reserve tries to tame inflation, those gains could be eroded.

- Slow Wage Growth: Pay has been rising rapidly for workers at the top and the bottom. But things haven’t been so positive for all professions, especially pharmacists.

Ordinarily, such a slowdown would be concerning, especially at a time when forecasters are warning of a possible recession. But in the up-is-down world of the late-pandemic economy, a modest pullback in job growth could actually be good news, albeit not for everyone.

That is because policymakers at the Federal Reserve believe that the job market is effectively overheated: With twice as many open jobs as job seekers, employers are competing for workers by pushing up wages and, ultimately, prices. The Fed is hoping that by raising interest rates, it can cool off the job market enough to bring down inflation, but not by so much that unemployment skyrockets.

“I think stability is very welcome right now for the economy,” said Michelle Meyer, chief U.S. economist for Mastercard. “If we have a glide path there, if we take these steps from 500,000 jobs to 300,000 to 200,000, that’s a better outcome than if we have a dramatic shock where suddenly next month we have negative job growth.”

There are signs the Fed’s plan may be working. The growth in the labor force should help ease the shortage of workers. Job openings have fallen from their peak last spring, wage growth has ebbed and fewer employees are quitting their jobs, an indication that competition for workers may have eased somewhat. Yet layoffs, despite a few high-profile announcements, have remained low, and employers have pared hiring plans, not abandoned them entirely.

“Yes, employer demand is cooling,” said AnnElizabeth Konkel, an economist at the career site Indeed. “In some areas, it’s cooling a little bit faster. But it’s still strong. It’s still robust.”

Still, any cool-down will have consequences for workers, who have enjoyed rare leverage in recent months. If there are fewer open jobs and employers are less eager to hire, companies might regain power, giving workers less room to demand raises, flexible schedules or other perks. Average hourly earnings rose 0.3 percent in August, a slower pace of growth than in recent months.