How a Drug Maker Profited by Slow-Walking a Promising H.I.V. Therapy

In 2004, Gilead Sciences decided to stop pursuing a new H.I.V. drug. The public explanation was that it wasn’t sufficiently different from an existing treatment to warrant further development.

In private, though, something else was at play. Gilead had devised a plan to delay the new drug’s release to maximize profits, even though executives had reason to believe it might turn out to be safer for patients, according to a trove of internal documents made public in litigation against the company.

Gilead, one of the world’s largest drugmakers, appeared to be embracing a well-worn industry tactic: gaming the U.S. patent system to protect lucrative monopolies on best-selling drugs.

At the time, Gilead already had a pair of blockbuster H.I.V. treatments, both of which were underpinned by a version of a drug called tenofovir. The first of those treatments was set to lose patent protection in 2017, at which point competitors would be free to introduce cheaper alternatives.

The promising drug, then in the early stages of testing, was an updated version of tenofovir. Gilead executives knew it had the potential to be less toxic to patients’ kidneys and bones than the earlier iteration, according to internal memos unearthed by lawyers who are suing Gilead on behalf of patients.

Despite those possible benefits, executives concluded that the new version risked competing with the company’s existing, patent-protected formulation. If they delayed the new product’s release until shortly before the existing patents expired, the company could substantially increase the period of time in which at least one of its H.I.V. treatments remained protected by patents.

The “patent extension strategy,” as the Gilead documents repeatedly called it, would allow the company to keep prices high for its tenofovir-based drugs. Gilead could switch patients to its new drug just before cheap generics hit the market. By putting tenofovir on a path to remain a moneymaking juggernaut for decades, the strategy was potentially worth billions of dollars.

Gilead ended up introducing a version of the new treatment in 2015, nearly a decade after it might have become available if the company had not paused development in 2004. Its patents now extend until at least 2031.

The delayed release of the new treatment is now the subject of state and federal lawsuits in which some 26,000 patients who took Gilead’s older H.I.V. drugs claim that the company unnecessarily exposed them to kidney and bone problems.

In court filings, Gilead’s lawyers said that the allegations were meritless. They denied that the company halted the drug’s development to increase profits. They cited a 2004 internal memo that estimated Gilead could increase its revenue by $1 billion over six years if it released the new version in 2008.

“Had Gilead been motivated by profit alone, as plaintiffs contend, the logical decision would have been to expedite” the new version’s development, the lawyers wrote.

Gilead’s top lawyer, Deborah Telman said in a statement that the company’s “research and development decisions have always been, and continue to be, guided by our focus on delivering safe and effective medicines for the people who prescribe and use them.”

Today, a generation of expensive Gilead drugs containing the new iteration of tenofovir account for half of the market for H.I.V. treatment and prevention, according to IQVIA, an industry data provider. One widely used product, Descovy, has a sticker price of $26,000 annually. Generic versions of its predecessor, Truvada, whose patents have expired, now cost less than $400 a year.

If Gilead had moved ahead with its development of the updated iteration of the drug back in 2004, its patents either would have expired by now or would soon do so.

“We should all take a step back and ask: How did we allow this to happen?” said James Krellenstein, a longtime AIDS activist who has advised lawyers suing Gilead. He added, “This is what happens when a company intentionally delays the development of an H.I.V. drug for monopolistic purposes.”

Gilead’s apparent maneuver with tenofovir is so common in the pharmaceutical industry that it has a name: product hopping. Companies ride out their monopoly on a medication and then, shortly before the arrival of generic competition, they switch — or “hop” — patients over to a more recently patented version of the drug to prolong the monopoly.

The drug maker Merck, for example, is developing a version of its blockbuster cancer drug Keytruda that can be injected under the skin and is likely to extend the company’s revenue streams for years after the infused version of the drug faces its first competition from other companies in 2028. (Julie Cunningham, a spokeswoman for Merck, denied that it is engaged in product hopping and said the new version is “a novel innovation aimed at providing a greater level of convenience for patients and their families.”)

Christopher Morten, an expert in pharmaceutical patent law at Columbia University, said the Gilead case shows how the U.S. patent system creates incentives for companies to decelerate innovation.

“There’s something profoundly wrong that happened here,” said Mr. Morten, who provides pro bono legal services to an H.I.V. advocacy group that in 2019 unsuccessfully challenged Gilead’s efforts to extend the life of its patents. “The patent system actually encouraged Gilead to delay the development and launch of a new product.”

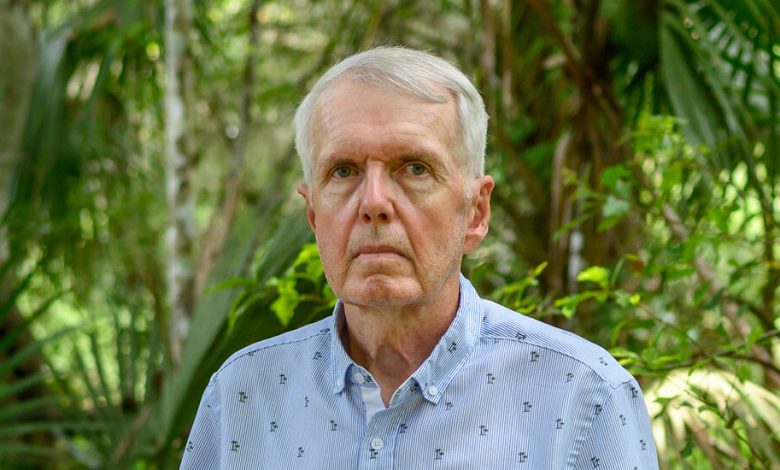

David Swisher, who lives in Central Florida, is one of the plaintiffs suing Gilead in federal court. He took Truvada for 12 years, starting in 2004, and developed kidney disease and osteoporosis. Four years ago, when he was 62, he said, his doctor told him he had “the bones of a 90-year-old woman.”

It was not until 2016, when Descovy was finally on the market, that Mr. Swisher switched off Truvada, which he believed was harming him. By that time, he said, he had grown too sick to work and had retired from his job as an airline operations manager.

“I feel like that whole time was taken away from me,” he said.

First synthesized in the 1980s by researchers in what was then Czechoslovakia, tenofovir was the springboard for Gilead’s dominance in the market for treating and preventing H.I.V.

In 2001, the Food and Drug Administration for the first time approved a product containing Gilead’s first iteration of tenofovir. Four more would follow. The drugs prevent the replication of H.I.V., the virus that causes AIDS.

Those became game-changers in the fight against AIDS, credited with saving millions of lives worldwide. The drugs came to be used not only as a treatment but also as a prophylactic for those at risk of getting infected.

But a small percentage of patients who were taking the drug to treat H.I.V. developed kidney and bone problems. It proved especially risky when combined with booster drugs to enhance its effectiveness — a practice that was once common but has since fallen out of favor. The World Health Organization and the U.S. National Institutes of Health discourage the use of the original version of tenofovir in people with brittle bones or kidney disease.

The newer version doesn’t cause those problems, but it can cause weight gain and elevated cholesterol levels. For most people, experts say, the two tenofovir-based drugs — the first known as T.D.F., the second called T.A.F. — offer roughly equal risks and benefits.

The internal company records from the early 2000s show that Gilead executives at times wrestled with whether to rush the new formulation to market. At some points, the documents cast the two iterations of tenofovir as similar from a safety standpoint.

But other memos indicate that the company believed the updated formula was less toxic, based on studies in laboratories and on animals. Those studies showed that the newer formulation had two advantages that could reduce side effects. It was much better than the original at delivering tenofovir to its target cells, meaning that much less of it leaked into the bloodstream, where it could travel to kidneys and bones. And it could be given at a lower dose.

The new version “may translate into a better side effect profile and less drug-related toxicity,” read an internal memo in 2002.

That same year, the first human clinical trial of the newer version got underway. A Gilead employee mapped out a development timeline that would have brought the newer formulation to market in 2006.

But in 2003, Gilead executives began to sour on rushing it forward. They worried that doing so would “ultimately cannibalize” the growing market for the older version of tenofovir, according to minutes from an internal meeting. Gilead’s head of research at the time, Norbert Bischofberger, instructed company analysts to explore the new formulation’s potential as an intellectual property “extension strategy,” according to a colleague’s email.

That analysis resulted in a September 2003 memo that described how Gilead would develop the newer formulation to “replace” the original, with development “timed such that it is launched in 2015.” In a best-case scenario, company analysts calculated, their strategy would generate more than $1 billion in annual profits between 2018 and 2020.

Gilead moved to resurrect the newer formulation in 2010, putting it on track for its 2015 release. John Milligan, Gilead’s president and future chief executive, told investors that it would be a “kinder, gentler version” of tenofovir.

After winning regulatory approvals, the company embarked on a successful marketing campaign, aimed at doctors, that promoted its new iteration as safer for kidneys and bones than the original.

By 2021, according to Ipsos, a market research firm, nearly half a million H.I.V. patients in the United States were taking Gilead products containing the new version of tenofovir.

Susan C. Beachy contributed research.