Meta’s ‘Unmitigated Disaster’ of a Quarter

The markets didn’t like what Mark Zuckerberg had to say.Credit…Facebook/Via Reuters

Meta’s virtual reality check

Lately, Mark Zuckerberg has been redirecting investors’ attention away from Facebook’s existing social media platforms and toward the exciting future of virtual worlds in the metaverse. (The company is now called Meta, after all.)

But those investors have sent Zuckerberg a strong message about the current state of his company, with Meta’s shares dropping as much as 20 percent in after-hours trading — erasing more than $175 billion in market value — in response to a disappointing set of quarterly results. The tech analyst Dan Ives of Wedbush Securities summed up the quarter as “an unmitigated disaster.”

What happened?

It’s not just the metaverse. The biggest hit to profits, which declined 8 percent in the fourth quarter and fell shy of analyst estimates, was spending on the Reality Labs division. Meta said it spent $10 billion last year on technologies developed by the unit that could eventually allow it to host users in a virtual world. That is an eye-catching sum — but investors knew that spending was coming. Other factors better explain the stock plunge.

Apple’s new privacy features are hitting Meta’s ad business. Meta said that its ad revenue would be down by about $10 billion this year because of recent changes that make it more difficult to track iPhone’s users’ digital habits. In the current quarter, Meta said that sales were set to grow as little as 3 percent, the slowest increase in the company’s history. Set against Google’s robust ad business, it seems that some advertisers are shifting to search platforms instead of social media. Shares of Pinterest, Snap and Twitter also fell sharply after Meta announced its results; those companies will report results soon.

TikTok is proving a formidable rival. Facebook’s namesake app reported the first (small) drop in users in its history. On yesterday’s earnings call, Zuckerberg acknowledged that the company is losing users to TikTok, especially younger ones. Meta’s offerings in video, including Instagram’s Reels, can compete with TikTok for attention, but “it will take a while to compound and catch up there,” Zuckerberg said. Meta may be further ahead in establishing itself in the metaverse, but that remains “a far-off revenue opportunity,” said Ives of Wedbush.

Does Meta’s big miss spell trouble for other corporate earnings? Things were looking pretty good at the halfway point of earnings season, as we noted yesterday, but the stock market’s four-day winning streak looks in danger today, based on futures trading. In part, that is because investors are punishing companies for missing analyst expectations more harshly than in the past, according to FactSet. Spotify’s slower-than-expected growth forecast was savaged by investors, as was PayPal’s similarly disappointing guidance (more on that below). Away from tech, industrial companies have been reporting relatively strong results, with Shell reporting bumper profits this morning. Back in tech, Amazon, which reports later today, could change the narrative yet again.

HERE’S WHAT’S HAPPENING

A nominee to the Fed faces a tough hearing today. Though three of President Biden’s picks for the central bank’s board are set to testify before the Senate, Sarah Bloom Raskin, who is up for the Fed’s vice chair for supervision, will be in the hot seat. Conservatives have criticized her for progressive ideas like using the Fed to help fight climate change.

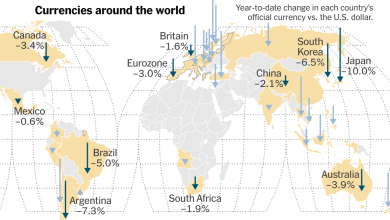

Inflation fears put pressure on Europe’s central banks. The Bank of England raised interest rates today as inflation runs at a decade-high pace. The European Central Bank is also set to meet today, with eurozone inflation recently hitting record levels.

A Moment of Change at CNN

- Jeff Zucker Resigns: The network’s president stepped down after failing to disclose a workplace relationship revealed during the Chris Cuomo inquiry.

- Chris Cuomo’s Downfall: The star anchor was fired for trying to help his brother, Andrew Cuomo, then the governor of New York, fight off a sexual harassment scandal.

- The Streaming Race: CNN+, a late arrival at the streaming party, is on a hiring spree. Can it get viewers already overwhelmed with options to pay?

- Direction in Flux: WarnerMedia, CNN’s parent company, is expected to be acquired later this year by Discovery Inc. in one of the nation’s largest media mergers.

The White House looks to limit the security risks of TikTok. The Commerce Department has ended a public-comment period for proposed rules on tighter federal oversight of foreign-owned apps that could be used to steal data. The next steps include writing a final rule that can survive legal challenges.

Melinda French Gates may spread her philanthropy around. The billionaire reportedly no longer plans to give the bulk of her wealth to the Gates Foundation, following her divorce from Bill Gates, according to The Wall Street Journal. Instead, she is expected to also give to her own nonprofit, Pivotal Ventures, and others.

An ethical A.I. researcher quits Google over cultural “rot.” Alex Hanna resigned from the tech giant yesterday, accusing the company of maintaining “white supremacy behind the veneer of race-neutrality” and doing little to address harms its products pose. She will join a research group founded by her former boss, Timnit Gebru, who says she was fired for raising similar concerns.

CNN after Zucker

Jeff Zucker resigned as president of CNN after he revealed a romantic relationship with another top executive at the network, which drew attention during the network’s investigation into the former anchor Chris Cuomo. “I was required to disclose it when it began but I didn’t,” Zucker wrote in a memo to staff. (His romantic partner, Allison Gollust, later said she would stay on as chief marketing officer.)

The abrupt end to Zucker’s nine-year tenure put CNN’s future in flux as its parent, WarnerMedia, is about to spin out of AT&T and combine with Discovery. The $43 billion WarnerMedia-Discovery deal, set to close by midyear, is a bet on the streaming might created by combining the two companies’ media properties, including CNN, HBO, HGTV and the Food Network.

CNN remains hugely valuable to WarnerMedia. Zucker and David Zaslav, Discovery’s C.E.O., are close. But Zaslav, who will run WarnerMedia-Discovery after its merger, has other reasons to care about CNN: It generates about $1 billion in annual pretax profit. It’s also a big platform to advertise the group’s other channels and offerings.

Its future may depend on CNN+. The streaming service set to launch this spring is intended to offset declining cable subscriptions. CNN has hired talent including Chris Wallace, Audie Cornish and Eva Longoria. And WarnerMedia is budgeting for 500 additional employees.

Zucker is — or was — key to the operation. He is known as a hands-on manager who commands loyalty from on-air stars, some of whom spoke out about his resignation. In a talent-dependent business like CNN, choosing his replacement will be critical. (For now, a team of Zucker’s deputies will run things.) With hosts that CNN+ has already signed, there’s likely little risk of them backing out since they are probably bound by contracts. But there is still recruiting to do for CNN+ — like maybe Brian Williams? — and at CNN, Chris Cuomo’s 9 p.m. slot remains unfilled.

PayPal crashes

The pandemic was initially good for PayPal, the payments processor that was spun out of eBay in 2015, as homebound consumers shopped online in droves. But the company’s disappointing earnings report this week showed how sharply its fortunes have turned.

Shares in PayPal plunged 25 percent yesterday, the single worst slide in its post-eBay life, taking them back near prepandemic levels. Its stock had been under pressure for months, with investors increasingly unhappy with moves like PayPal’s aborted $45 billion bid to buy the social network Pinterest.

Investors were spooked for two big reasons:

-

The company cut its earnings forecast for 2022, with executives citing a resurgence in in-store shopping, supply chain disruptions and inflation reducing the buying power of lower-income customers. EBay’s effort to build out its own payments arm also hurt.

-

Executives also abandoned an ambitious user-growth plan after admitting that an expensive marketing campaign attracted consumers who spent little. (About 4.5 million accounts were created just to collect sign-up incentives.) The company said it will now focus on enticing existing users to spend more.

It’s another example of pandemic stars falling back to earth, as life slowly returns to pre-2020 routines. (See also: Zoom and Peloton.) Other payments services have suffered — Block’s shares fell 10 percent yesterday — but PayPal’s management specifically has its work cut out to restore investor confidence.

Exclusive: Coinbase wants to turn your tax refund into crypto

Coinbase is trying to establish itself as a mainstream gateway to the world of cryptocurrency,a place to routinely deposit paychecks, expense reimbursements and tax refunds. Today, it launched a direct deposit program with the software company TurboTax to send state and federal tax refunds to Coinbase accounts, with the option to automatically convert dollars into crypto, DealBook is first to report.

“We’ve seen a rise in alternative investments, in a new class of investors beyond just high-income earners,” said Randy Hellman of TurboTax’s investor segment.

Coinbase sees itself as an “on-ramp” to the crypto economy. It wants to make things easy for people by offering direct deposits of all kinds, said the company’s head of product, Prakash Hariramani. Coinbase just finished the U.S. rollout of a paycheck program, with New York City mayor Eric Adams naming the company in a statement on converting his first mayoral income from dollars to crypto. Coinbase also lets people direct corporate expense reimbursements to their crypto accounts.

But holding Dogecoin isn’t the same as having a dollar. Given crypto’s high volatility, even enthusiastic early adopters of these sorts of services are proceeding with caution. “The education piece is really critical,” said Sally Shin, who leads strategy at the music distributor United Masters, which is working through the initial phases of a partnership with Coinbase to design a crypto payment program for employees and artists.

THE SPEED READ

Deals

-

The W.N.B.A. raised $75 million in its first round of outside investment, from the likes of Nike, Condoleezza Rice, Laurene Powell Jobs and Michael Dell. (NYT)

-

Lawyers for Elon Musk argued that he was truthful in tweeting that he had “funding secured” to take Tesla private in 2018, because he had backing from Saudi Arabia to do so. (Insider)

-

United Airlines reportedly may sell a minority stake in its MileagePlus loyalty points program, which was valued in 2020 at $22 billion. (Bloomberg)

-

British Telecom is in talks to form a joint venture with Discovery for its sports business, abandoning efforts to sell the division to the streaming platform DAZN. (FT)

-

The dog-walking app Wag reportedly plans to go public via — what else? — a SPAC. (Bloomberg)

-

Speaking of SPACs, companies that went public by merging with them were among the biggest market losers last month. (CNBC)

Policy

-

Google’s victory over a Czech search engine helped inspire an E.U. antitrust law that could limit its market power. (NYT)

-

The U.S. Postal Service is defying President Biden’s climate plans by ordering a fleet of gasoline-powered trucks. (NYT)

-

Why is Biden snubbing Tesla? (Bloomberg)

-

“A U.S. Digital Dollar Should Serve the Public, Not Banks” (Bloomberg Opinion)

Best of the rest

-

HBO Max is premiering a documentary about the activist investor Carl Icahn this month. (Realscreen)

-

Washington’s N.F.L. team has a new name — but fans aren’t impressed. (WaPo)

-

Inside Miami’s effort to court business and become “the most important city in America.” (FT)

-

Meet the start-ups selling direct-to-consumer cremation services. (NYT)

-

“Why is Matt Damon Shilling for Crypto?” (NYT Magazine)

We’d like your feedback! Please email thoughts and suggestions to [email protected].