Do You Wish You Lived in a Low-Tax State?

Tax Day — April 15 — is looming in the United States. While federal income taxes apply everywhere, state and local taxes vary state by state. The differences in the total tax burden among the 50 states, as a proportion of personal income, can make a significant impact on a household budget.

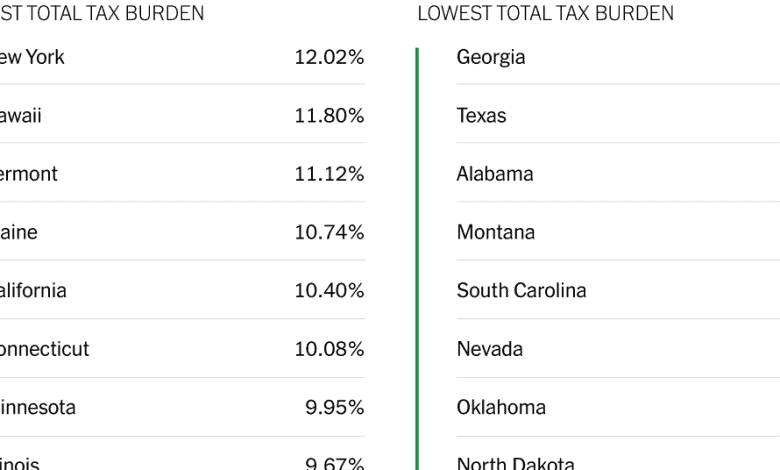

A study by WalletHub measured the share of personal income paid by residents in individual income taxes, property taxes, and sales and excise taxes (those levied on goods and services), and ranked every state by its total tax burden. The data for the rankings were drawn from the Urban-Brookings Tax Policy Center, a nonprofit that analyzes tax issues.

New York State’s tax burden was highest, over 12 percent. Hawaii, Vermont, Maine and California followed, each topping 10 percent. At the other end of the scale, Alaska has a tax burden less than half of New York’s, or slightly below 5 percent. New Hampshire, Wyoming and Florida followed, all roughly six percent.

Important to homeowners, Maine, Vermont and New Jersey were found to have the highest property taxes. Sales and excise taxes combined were highest in Washington, followed by Nevada and Hawaii — exceeding 5 percent in each.

This week’s chart shows the 15 states with the highest total tax burden and the 15 with the lowest, according to WalletHub.

For weekly email updates on residential real estate news, sign up here.