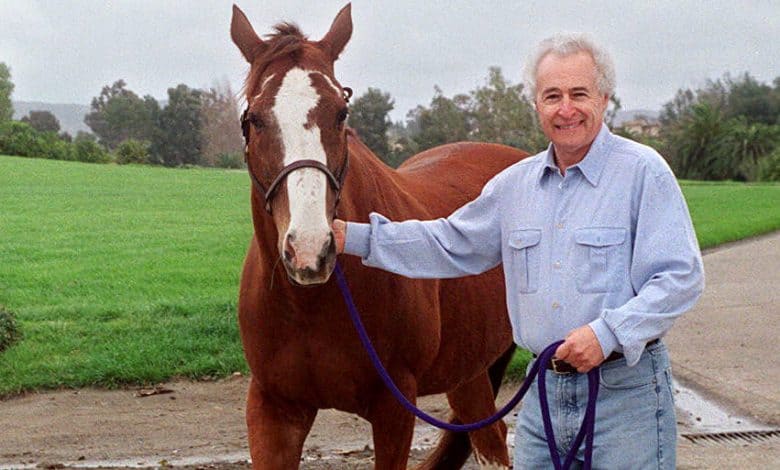

Martin Wygod, a Winner on Wall Street and the Racetrack, Dies at 84

Martin J. Wygod, a Wall Street whiz who graduated from walking horses after races to owning and breeding championship thoroughbreds when he made millions from investing in online companies that sold pharmaceuticals by mail and pruned medical paperwork, died on April 12 in San Diego. He was 84.

His daughter, Emily Bushnell, said he died in a hospital from complications of lung disease.

Raised near two racetracks in suburban New York and mentored by a software pioneer, an investor and a gambler, Mr. Wygod was said to have been the youngest managing partner of a New York Stock Exchange brokerage in the 1960s. He became a millionaire before he was 30, and in 1993 he sold Medco Containment Services to Merck for $6 billion after building it into the nation’s largest mail-order prescription drug company and benefit manager in less than a decade. The sale netted Mr. Wygod $250 million.

“The name of the game in the future is going to be information,” Jan Buck, chairman of Princeton Group International, a pharmaceutical industry consulting firm, commented on the sale to The New York Times in 1994. “Marty Wygod made $6 billion for himself because he developed a data base.”

Mr. Wygod then became the chairman of WebMD, a leader in online health information services, which he sold in 2017 for a reported $2.8 billion.

He married Pamela Yellin in 1980, and in 1995 they moved from New Jersey to River Edge Farm, a 110-acre spread in Buellton, Calif., where they raised fillies and colts to become top racehorses.