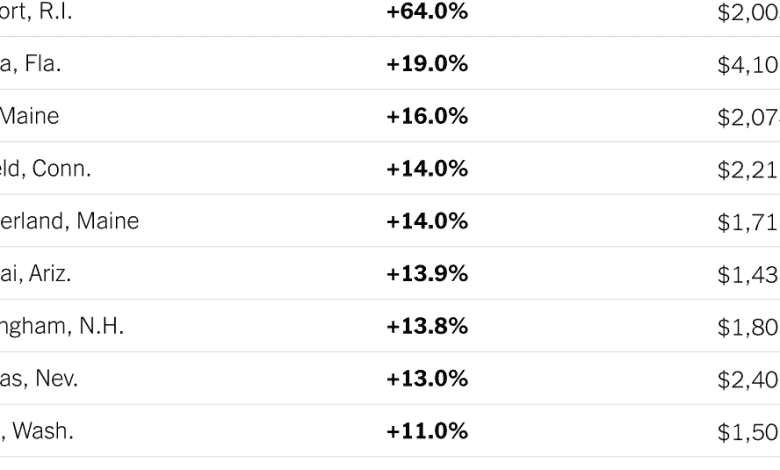

The Hottest Luxury Second-Home Markets

It’s hard enough buying a first home these days. Who on Earth is out there buying a second one? The wealthy, mostly: In 2023, sales of luxury second homes increased in many U.S. markets.

A study from Pacaso, a company specializing in brokering co-ownership home purchases, parsed data from the real estate analytics firm First American Data & Analytics to find the counties where sales of luxury second homes — “luxury” here meaning a sale price over $1 million — increased the most from 2022 to 2023. (Only homes designated for seasonal or recreational purposes were included in the study, and counties with fewer than 20 sales of luxury second homes were not included.)

In Newport County, R.I., sales of luxury second homes were up 64 percent, far surpassing all other U.S. counties. The waterfront county, known for its Gilded Age mansions, had an average sale price of $2,003,945 among homes in this price range. To get a sense of the overall market in Newport, we scanned the current listings there (second homes or otherwise) and found 83 homes priced for more than $1 million, and 71 for less.

The next greatest boost for luxury second homes came in Volusia County, Fla., which includes Daytona Beach. Sales rose 19 percent, but at a higher average sale price than in Newport, $4.1 million. Our Zillow research showed that as of Monday, among all listings there, about 300 were priced for more than $1 million, with about 5,500 available for less. That’s understandable: Volusia County is much larger than Newport and has many more residents.

The 10 counties with the most year-over-year growth for luxury second homes are shown in this week’s chart. In the New York tristate area, it includes Westchester County, N.Y., and Fairfield County, Conn.

In addition to transactions, price increases for luxury homes were also calculated in Pacaso’s study. Volusia County topped that list with a 47 percent increase in the average sale price from 2022 to 2023. Atlantic County, N.J., was next, with prices up 41 percent to an average of $2,9 million.

For weekly email updates on residential real estate news, sign up here.