With the Capital One-Discover Deal, Credit Holds All the Cards

A fight has commenced over Capital One’s effort to acquire Discover, a deal that would birth an enormous credit-card company rivaling Visa, Mastercard and American Express. The resulting competition could, in the short run, lower some costs to businesses and consumers. However, over the longer term, the merger would keep intact the broken and predatory system in which credit-card companies profit handsomely by rewarding our richest Americans and advantaging the biggest corporations.

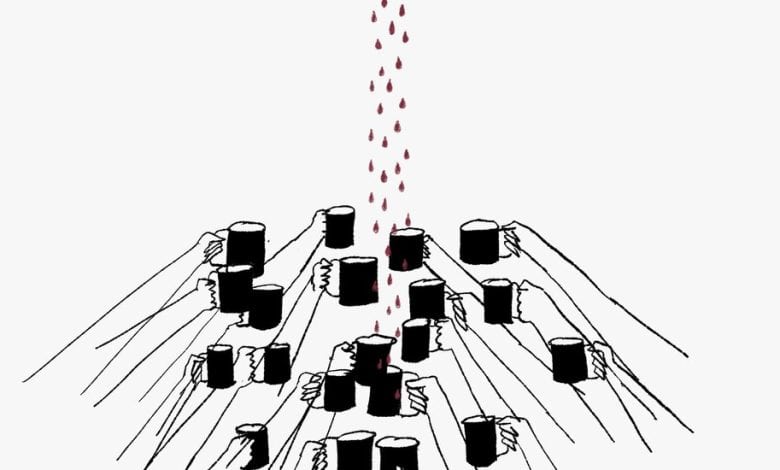

Credit-card companies increasingly generate money via swipe fees, or the money merchants pay issuers every time a credit card is used. Total swipe fees rose 20 percent in 2022 to an estimated $160 billion a year nationally. The pandemic changed how we buy things, significantly increasing the share of transactions put on credit cards rather than conducted in cash, adding to the swipe fees merchants pay.

On top of this, a 2018 Supreme Court ruling effectively forces merchants to accept either every type of card — from, say, a basic Green Card to the Platinum Card — from an issuer like Amex or none of them. And even though fancier types of cards generally demand higher swipe fees, the ruling also barred merchants from incentivizing consumers to use the cheaper ones. These facts combine in a way that makes it even more appealing for Capital One, a giant credit-card issuer, to merge with Discover, which owns a payment system, and generate greater profits from credit cards, particularly higher-end reward cards.

transcript

Your Rewards Card Is Actually Bad for You, and for Everyone Else

Chasing credit card points is a game in which everyone loses.

This is a story about you and your favorite credit card, the one that earns you points. You use your card for everything. You pay off your balance every month. And you watch with glee as your rewards grow and grow and grow. And when it’s time to cash in, you announce that you’re going to get a family gift. And each member will get one vote. And then your daughter argues that the family needs another iPad. And your son has fallen in love with the ugliest garden gnome that you’ve ever seen. And so to break up the skirmish, you decide that you’ll be getting the frying pan. Because what brings the family together more than food? Marty is the answer. But let’s keep him out of this. And when they complain and say, “But that’s not what I wanted,” you look them in the eye and say, “This was never about you.” “It’s about us, all of us.” And then two weeks later your frying pan arrives. And you can’t help but smile because you kind of did get this for yourself, though you’ll never admit it. And you’re looking at the frying pan. And it’s staring at you and you at it and it at you and you at it. And you just have this split second where you think to yourself: Who actually paid for this? Who pays for all of this? Well, if you love your rewards card, then you’re probably not going to like the answer. Because you try to be a good person, you shop locally. And each week you buy, let’s say, $100 in groceries from MJ. When you swipe your card, that $100 doesn’t go straight to MJ. Instead, store owners are charged a series of fees, the largest of which is called the swipe fee. It’s set by the card network, usually Visa or Mastercard. And your bank uses it to pay for your rewards. The swipe fee is usually between 1.5 percent and 3.5 percent of your total. The more premium your credit card, the more that MJ is charged. Now, that might not sound like much. But it can add up. For small businesses like MJ’s, swipe fees can be one of their biggest expenses. And small stores like hers get charged higher rates than big-box competitors. In order to cope, store owners like MJ raised their prices. That means that all of us are paying more. But only those who have special cards are getting rewards. And here’s the catch: The wealthiest Americans tend to have the best cards that give them the most rewards, while poorer Americans are more likely to pay in cash or debit with no rewards or benefits. So what we really have is a system that forces everyone to pay higher prices in order to subsidize rewards that primarily go to the wealthy. So this rewards card, it’s really a screw-over-poor- people card. Every time you use it, you’re contributing to inequality, helping to drive up prices and further squeeze the most cash-strapped Americans, all so that you can get that free frying pan. You’re probably not benefiting from rewards as much as you thought. In 2020, the Federal Reserve found that the average American at every income level loses more to swipe fee price hikes than they earn in rewards. And of course, the poorest Americans are still getting handed the worst deal. On average, they pay five times more in price mark-ups than they’ll ever receive in rewards. Why are we stuck in this system? Why are swipe fees in the U.S. nine times higher than they are in Europe? Why do we have to pay so much just to pay? Well, it’s largely thanks to two companies, Visa and Mastercard. This system is their core business. It’s what they do for a living. And, sure, they’re providing a service and deserve to earn a profit. But these two companies control over 80 percent of the credit card market. With scant competition, Visa and Mastercard have faced little pressure to rein in swipe fees. The truth is for the vast majority of Americans, the best deal might not come in the form of a new piece of plastic but instead a new piece of legislation. That’s because Congress has the power to regulate swipe fees. In fact, in 2010, they did just that for debit cards. Remember the swipe fee on that $100 grocery purchase? If you paid with a debit card, it would have only cost MJ 26 cents. Dick Durbin, the senator who helped crack down on swipe fees for debit cards, has authored a bipartisan bill that would use competition to drive down credit card swipe fees. But the banks and credit card companies are, of course, pushing back. Right now, there are two things that you can do. First, call your senator and encourage them to support this bill. You can go to this website to find their number. Second, if you’re shopping at a small business that you want to support, remember that how you pay can make a difference. Using your debit card can save small businesses a lot in swipe fees. But the best solution might be elsewhere in your wallet. Increasingly, small businesses are offering discounts for cash payers. Avoiding this predatory system can be a win for both of you. And if those rewards are just too good to say goodbye to, well, then at least don’t go around telling people that you’ve never taken a handout, because you have. And the working class is paying for it. [MUSIC PLAYING]

Chasing credit card points is a game in which everyone loses.

Credit-card companies found they could command ever-greater swipe fees from merchants while at the same time offering their wealthiest consumers more deluxe credit cards that reward big spending with cash back, travel points, access to fancy airport lounges and the like — and then pass on the cost of those rewards to merchants. Merchants must then choose whether to accept and pay the higher swipe fee demanded by these platinum expensive cards or not take anyfrom that card company. In our increasingly digital economy, most merchants have little alternative but to accept the pricey versions and to pay for the privilege. Naturally, merchants pass on their increased cost to all of their customers.

That’s how the rest of us, whether we pay with cash, a debit card or a middle-of-the-road credit card, wind up paying more — because we are subsidizing these rewards cards for whom only the wealthiest qualify. One study from economists at the Boston Federal Reserve estimated that the highest-income households profit over $1,000 a year tax-free from the payment system, adjusted for inflation.